Let's Talk Budget!

Think of the Town’s budget as a plan for how we invest in our community. Every dollar helps fund the services and projects that keep Perth running and growing — from snow plows to playgrounds, fire safety to festivals.

Just like a household or business budget, the Town makes careful choices about how to spend money on services and infrastructure. Our goal is to meet community needs today while planning for a strong future.

Because you live, work, or own property here, the budget affects you every day.

Take a look at the information below, browse the FAQs, and share your thoughts in the survey to help shape Perth’s 2026 budget

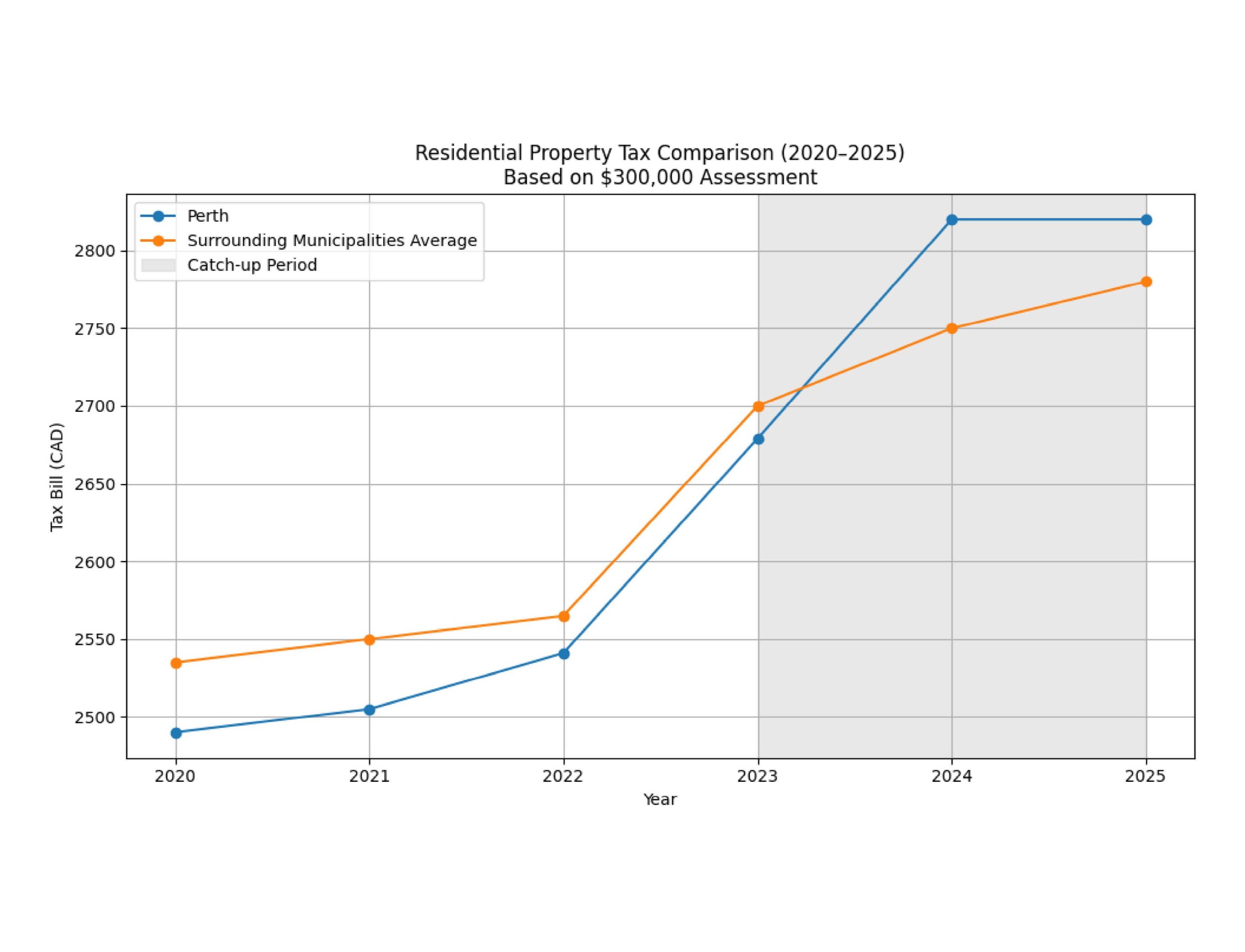

These charts show how residential property taxes in Perth compare to the average of nearby municipalities, based on a home assessed at $300,000.

From 2020 to 2022, Perth residents paid below the regional average. Since 2023, the Town has been in a ‘catch-up’ phase, meaning tax bills are now higher as we work to match neighbouring municipalities and ensure we can adequately fund our infrastructure and community programs.

Like all municipalities, Perth faces rising costs that are both within and beyond our control. While we continue working to deliver services efficiently, several key factors are putting pressure on the Town’s budget in 2026:

- Provincially-negotiated OPP contract – policing costs are set at the provincial level, and increases are passed on to municipalities.

- Labour contracts – negotiated agreements with staff determine wages and benefits.

- Inflation and escalating costs – higher prices for supplies and labour, especially for capital projects like roads, water, and sewer.

- Aging infrastructure – older roads, pipes, and facilities require more investment to maintain and replace.

- Provincial downloading – new or expanded responsibilities from the Province, without matching funding, increase costs for municipalities.

We are committed to balancing these pressures while continuing to provide the services our community relies on every day.

To help reduce the impact on taxpayers, the Town used a mix of strategies, including:

- Finding efficiencies within departments

- Deferring non-essential projects or purchases

- Using reserves and surplus funds where appropriate

- Adjusting investment revenue

- Making use of provincial and federal grants

- Adding tax revenue from new development in Perth

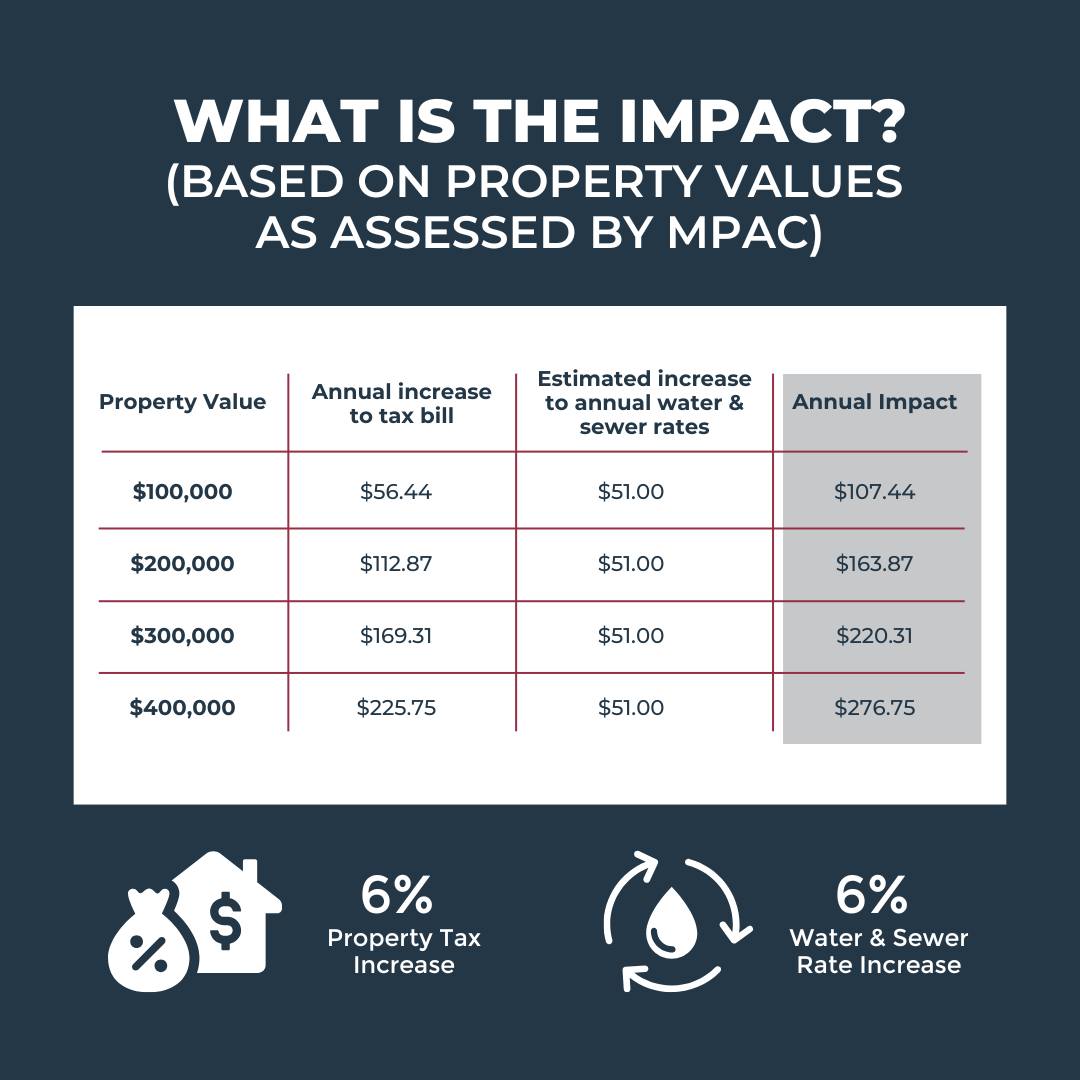

Every year, the Town works to balance the cost of delivering services with the impact on taxpayers. Property taxes are calculated using the assessed value of your property, as determined by the Municipal Property Assessment Corporation (MPAC).

The graphic below shows the impact of last year’s property tax increase, along with the proposed increase to water and sewer rates, for homes assessed at $100,000, $200,000, $300,000, and $400,000.

The Town collects the municipal portion of your property tax bill. Other charges, such as county or school board taxes, are set by other levels of government and are not controlled by the Town.

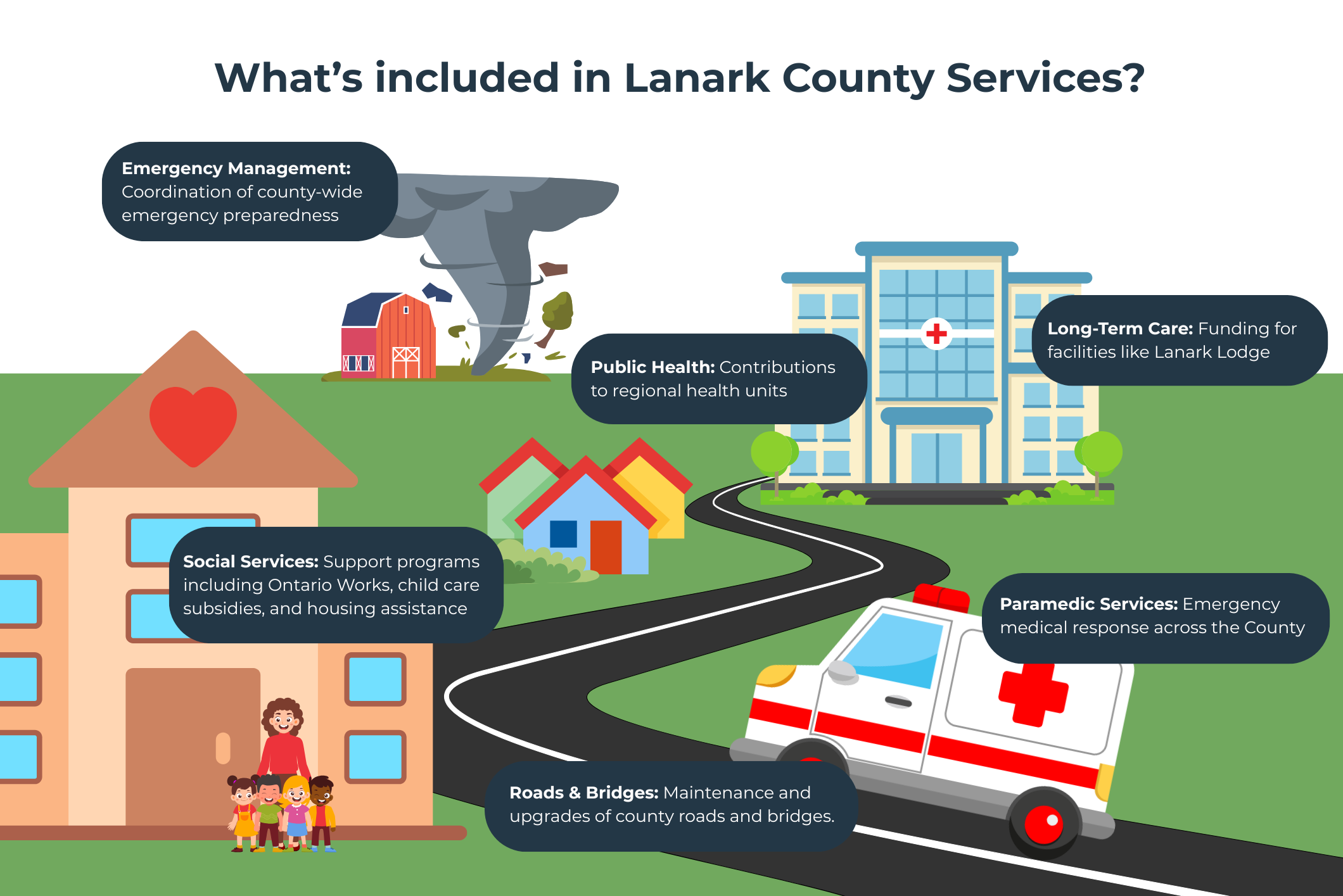

our property taxes don’t all stay with the Town. They’re shared between different levels of government to support a wide range of services:

- 63% goes to Town of Perth services

- 26% goes to Lanark County services

- 11% goes to Education (Province of Ontario)

The graphics below show how these funds are divided up — and what services are covered by the County and the Town.

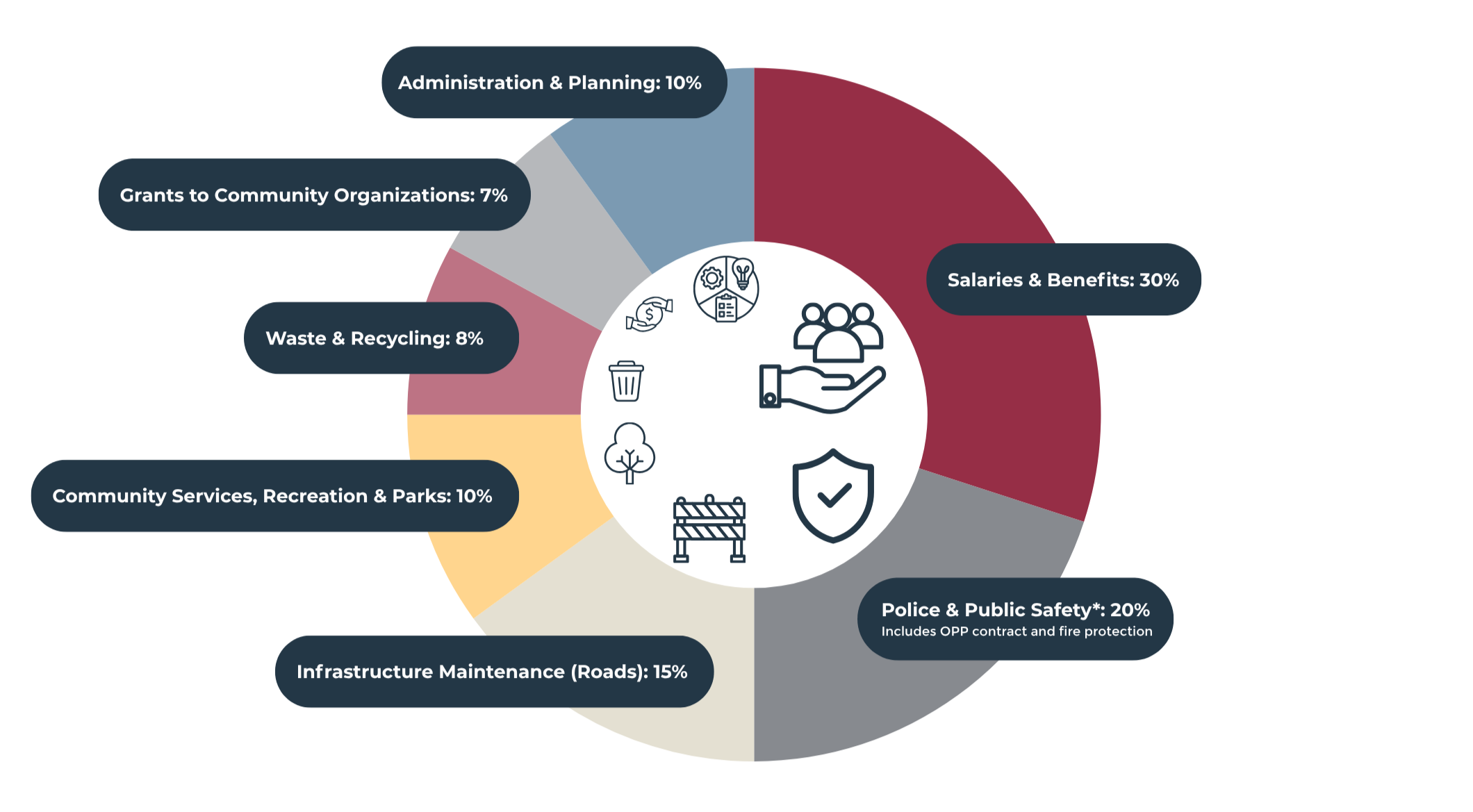

How is the 63% on Town Services allocated?

Just like schools and hospitals, municipalities are service providers. A significant portion of the Town’s budget goes toward the people who deliver services in our community. From keeping roads safe in the winter and maintaining parks, to responding to emergencies and supporting local events — these services all depend on skilled staff. Investing in people is how we provide safe, reliable, and responsive services to our community.

A property’s assessed value determines its share of property taxes. In Ontario, assessments are set by the Municipal Property Assessment Corporation (MPAC). The last province-wide assessment update was in 2016, and there are no current plans for a new reassessment.

This means your property’s assessed value is still based on that 2016 update. Even though property values have changed since then, the Town must continue to use MPAC’s assessed values when calculating property taxes.

For more information about your assessment, visit mpac.ca.

2026 Mayor's Budget Approved

On Tuesday, December 9, the Council of the Town of Perth approved the 2026 Mayor's Budget.

All About Budget, Taxes & More!

Who is responsible for what in Perth?

How Your Property Tax is Calculated

Why Invest in Asset Management?

Cumulative Changes Since 2013 - Perth Property Tax Rates vs Construction and Consumer Price Indexes